Canberra office market resilience amidst uncertainties

The previous economic upheaval has well approved the stability of Canberra office demand, with the government as a major tenant.

As a result of the economic shock caused by COVID-19, we recorded market volatility across all major Australian CBD office markets. As organisations contracted and reassessed their space requirements, the blended Australian CBD vacancy rate increased from 8.3% in 4Q19 to 13.5% in 1Q22.

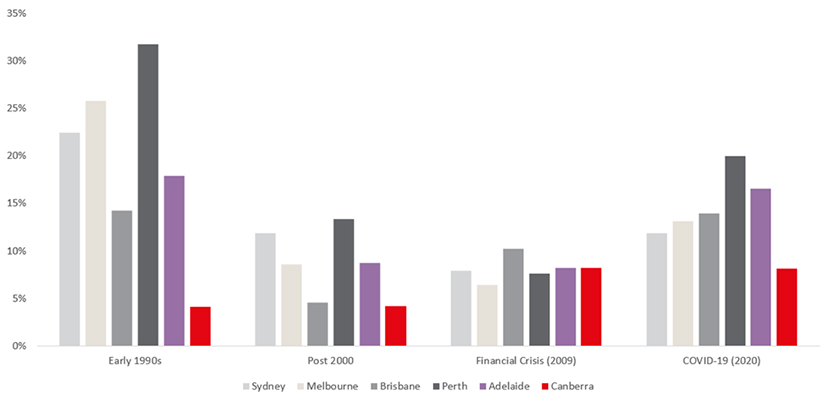

The impact played out over 2020, with all Australian CBD markets recording a rise in the vacancy rate to varying degrees. The only exception to this trend was the Canberra office market, which recorded a decline in the total vacancy rate from 10.6% in 4Q19 to 8.2% in 4Q20. From that period, the Canberra vacancy rate has continued to trend downwards at 5.5% in 1Q22. This vacancy rate is currently the second-lowest out of the 19 Australian office markets tracked by JLL Research and is one of the lowest in the world compared to other global cities. In addition, Canberra consistently has had the lowest vacancy rate compared to other Australian CBD markets, on average, in the four economic downturns highlighted in Figure 1.

Figure 1: Australian CBD market vacancy rate peaks during economic downturns/slowdowns

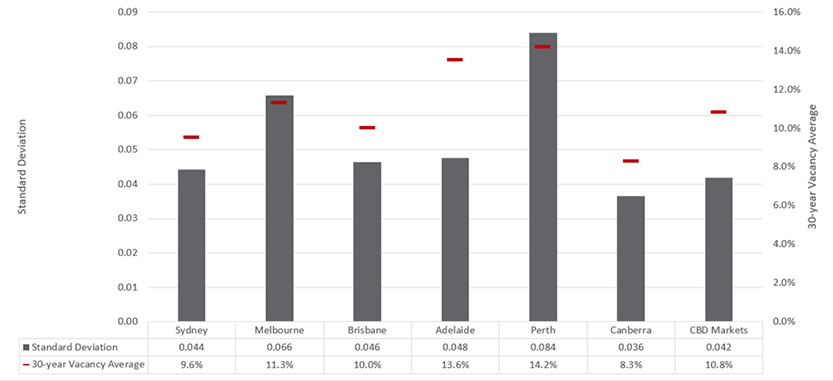

We have calculated the standard deviation of historical vacancy in each CBD market to identify the volatility of Australian CBD office market vacancy rates. In the past three decades, the standard deviation across all Australian CBD markets was 0.042, while Canberra’s standard deviation was 0.036, the lowest among all CBD markets. Statistically, it means the variation of the Canberra vacancy rate over the past 30 years was well below the national average, highlighting the stability of the market.

Figure 2: Standard deviation of Australian CBD vacancy rates

What is the reason for this long-term stability? A key reason is the high proportion of occupancy of the public sector. In the latest Australian Government Office Occupancy Report, issued by the Department of Finance, approximately 62% of the Canberra office space was tenanted by the Commonwealth (Federal Government of Australia). The report highlighted that the public sector occupied 1.12 million sqm of usable office area across 159 government tenancies in Canberra. It is close to the total size of the Adelaide CBD office market (1.44 million sqm).

Furthermore, in 2021 we also recorded demand from the private sector starting to pick up, especially from government contractors. Some notable leases of last year included SRC Australia expanding into 38 Sydney Avenue, Barton (1,800 sqm), and Cybercx leasing 1,100 sqm in 68 Northbourne Avenue, City. This further supported a fall in the Canberra vacancy rate.

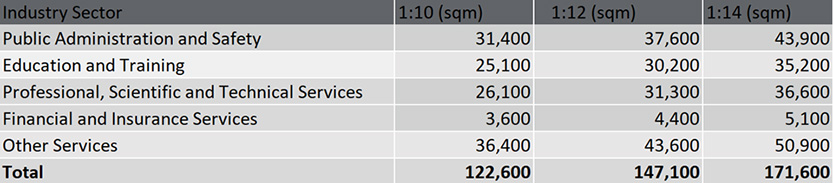

Moving forward, we are projecting to see an uplift in employment in the defence sector (according to government budget papers) as well as an expansion of the private sector. Based on Deloitte Access Economics employment forecasts, we have modelled the underlying demand for Canberra’s office space over the next five years based on the key white-collar employment sectors in Figure 3. Under the scenario of a 1:14 worker to space ratio, which is the targeted ratio in the public sector, it would imply a demand of 171,600 sqm of office space between 2022 and 2026.

Figure 3: Canberra CBD underlying demand model, 2022 to 2026